It seems that yet again LF was right on the money. Matthew Blomfield, the man who is attempting, so far unsuccessfully, to sue blogger Cameron Slater of Whale Oil fame has hit the news yet again. Funnily enough its again for all the wrong reasons; reasons that run counter to the claims he has made before the court, in his case against Slater. Slater of course having, now somewhat infamously labelled Matthew Blomfield a fraudster.

Of course at the time Slater made his allegations he did little more than wack up a few obscure documents that had been located on a hard drive the Blomfield later claimed had likely been stolen in a “burglary”.

Cameron Slater then expected his readers to put “one plus one” together themselves, not at all a good call really.

Slater later inexplicably removed all of the posts he’d published that involved the allegations he’d made against Blomfield, apparently according to sources close to Slater because he had obtained an undertaking from Blomfield that it would then be an end to the matter. Slater apparently later claiming that he had accepted this course of action only because, at the time, he was dealing with issues surrounding his late mothers death.

As LF have said many times before, Slater is inherently lazy, he’s also duplicitous in nature, as is some of the crap he posts on the Whale Oil blog. We’re not quite sure why Slater suddenly adopted the strange notion that Blomfield was a man of his word, having just accused Blomfield of being anything but.

It does seem however that Slater having dissed Blomfield, without actually understanding himself the crux of the allegations he had made, was certainly a factor in Slater wanting to take the easy way out, rather than standing by the accusations he’d made.

It certainly did not help Slater that he is in fact not that dissimilar to Blomfield, in that he is also inherently dishonest, the only difference being that Slater is dishonest with his readers and Blomfield with his creditors, one being criminal in nature, the other merely morally bankrupt; which of course is not an imprisonable offence.

Whale Oil’s Cameron Slater, too lazy for his own fucking good! Of course Slater often likes to take credit where absolutely none is due!

By simply labelling Blomfield a crook and fraudster Slater in fact achieved very little. It certainly did not bring about any change in circumstance for the people and corporate entities that Blomfield and his cabal had screwed financially, nor for that matter any hope of change, once the Slater-dust had settled.

Statutory investigative bodies such as the SFO and the official assignees office undoubtedly simply looked at Slater’s allegations and quietly said……Oh Well, what do you expect us to do!

If one wishes to make a complaint then it is to some degree incumbent on the complainant to offer certain particularity, specifics, not just…..“Ah well he’s…….. you know, he’s a fucking fraudster”.

It is only be expected that any policing agency tends to want specific allegations and evidence they can comprehend that “supports”, at least prima facie, the allegations; a case of sorts to be made out.

Slater of course provided none of this in most of his posts on Whale Oil, even his readers were probably left wondering what the hell he was on about. Which more often than not is the case….but they will still blindly follow.

That fact combined with Slater then pulling down the allegedly “defamatory” posts undoubtedly created the “back door” that Blomfield had hoped for, later using these very circumstances to manufacture the allegations and statement of claim for the defamation tort Cameron Slater is currently facing.

The latest newspaper piece on Blomfield is to be found in New Zealand’s National Business Review (NBR), a highly dodgy little Kiwi publication that had historically been into publishing false and defamatory material itself, way back in the days when Warren Berryman was editor, and Jenni McManus a young and highly incompetent intern, both of whom often stooped to criminality just to avoid prosecution and justice themselves.

The NBR has of course been used by Blomfield in the more recent past to publish material that was little more, in LF’s opinion, than a number of carefully scripted smoke-screens, manufactured by Blomfield himself, likely with the intention of concealing his own offending, aka frauds; one in particular being against Blomfield victims and farmers, Boris and Jean Yelcich.

The NBR’s latest piece however seems to herald a sudden change of heart by their editor or the assigned journalist thats managed to see through Blomfield’s poor me hyperbole; which may well also be indicative of various other investigations that are now underway.

This fact may also be the reason why one of the many liquidator’s involved has decided to be a little more open and frank, perhaps even attempting to mitigate the rumours and allegations circulating with respect to his involvement in Blomfields dodgy dealings:

Blomfield fails to collect cash for brother’s liquidation

Auckland businessman Matthew Blomfield is being snubbed by debtors following attempts to collect cash for his jailed brother’s liquidation.

Mr Blomfield is known for running Hell Pizza’s edgy marketing campaigns through his advertising company Cinderella Communications, which was put into liquidation in 2008.

Last month NBR ONLINE revealed Mr Blomfieldwas attacked in his Auckland home. NZ Police say they have no further comment on the matter.

Grant Thorndon associate Greg Sherriff, who is liquidating Mr Blomfield’s brother Dan Blomfield’s company, says he had originally engaged the brother, Matthew, to help with the liquidation of Civil Solutions Holdings.

He says the incarceration of Dan Blomfield has made debt collection difficult. Dan Blomfield was sentenced to a jail term for assault earlier this year.

“Initially I asked Matt to see if he could help assist in the collection of debts and that didn’t really work because they didn’t trust the change of name from Dan to Matt,” Mr Sherriff says.

Dan Blomfield voluntarily liquidated the excavation company when faced with jail time, according to Mr Sherriff.

He says while at first blush it appeared the business had enough owed by debtors to repay its creditors; debtors were taking advantage of his incarceration to avoid paying up.

The accounts receivable of the company was $334,596 at the date of liquidation, he says.

Mr Sherriff says to date unsecured claims are $181,396, while the IRD is owed $38,117 and an employee is owed about $3,000.

He described the likelihood of a solvent liquidation as “doubtful” and says as it stands now creditors would get 50c in the dollar but circumstances could change if they were able to recover more debt.

He says the nature of the industry means a lot of the jobs are made by verbal arrangements instead of written requests, and that many debtors were also creditors.

However, Mr Sherriff says Dan Blomfield told him will leave prison within the next three months and then be able to recover the debts.

Less than a fortnight before the company’s liquidation on November 9, Mr Blomfield withdrew $37,000 as owners’ drawings.

Mr Sherriff says this payment – which was made to Mr Blomfield’s lawyer Central Park Legal – will be looked at if the liquidation becomes insolvent.

“The withdrawal of the money prior to liquidation of $37,000 does stick out – it was sent to his lawyers on trust and disbursed on his behalf,” he says

Source: URL link unavailable, (NBR article transcript supplied by LF reader).

The NBR article is interesting, not so much for what it reveals, more for what it in fact conceals. Was it the journo or the liquidator who decided not to name the lawyer involved, instead using the name of the fairly recently created “Central Park Legal”.

Certainly that name is unlikely to ring any bells for anyone who’s had past dealings with Matthew (Matt) Blomfield or his brother Daniel (Dan), except perhaps those who have been following events carefully.

Why has the NBR Journo failed to name the lawyer responsible? The same lawyer that’s been behind almost all of Blomfield’s many scams.

The fact of the matter is that the man hiding behind “Central Park Legal” is none other than ex Corban Revell law partner, Bruce Johnson LLB. As aforesaid Johnson’s hand is to be found behind almost all of Matthew Blomfield’s deals, now apparently also that of his brother Dan’s highly suspect company liquidation.

The NBR article is also notable in that the Journo seems to have failed to ask the liquidator one or two very pertinent questions. Amongst the issues, wherein further question should almost certainly have been asked is a matter that the liquidator himself raises and then answers himself, albeit in a rather peculiar way. Its the small matter of what appears to have been an unlawfull preferential payment, paid into, none other, than Bruce Johnson’s trust account, just before Daniel Blomfield (or was it) placed the company in liquidation.

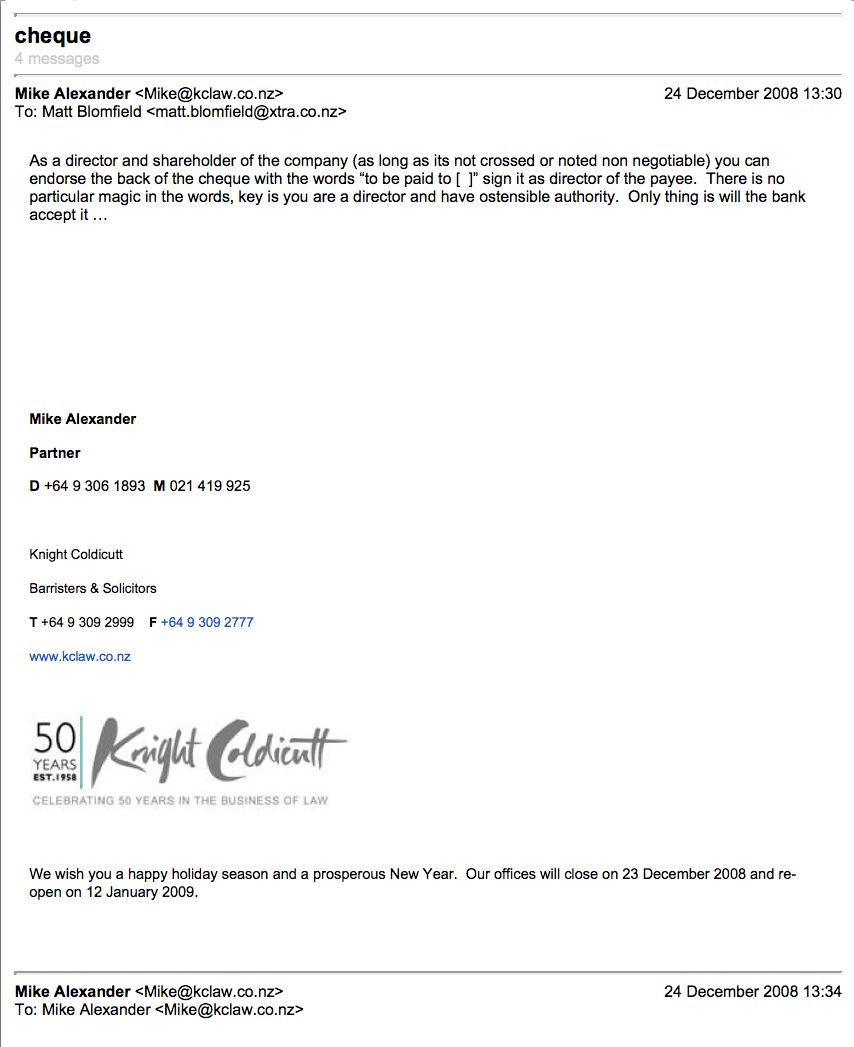

Of course Bruce Johnson is not the only lawyer anyone dealing with Blomfield needs to be weary of. Blomfield has used various other dodgy legal operatives in his equally dodgy dealings. One such “lawyer” that is deserving of particular mention in addition to Bruce Johnson is Mike Alexander who LF suspects has also employed questionable tactics to move cash around various parties other than those who, strictly speaking, had been the intended recipient;

Now LF have raised the issue of Blomfield and Johnson’s use of the old preferential payment scam just prior to receivership or liquidation of Blomfield’s companies. In particular a payment that was allegedly made to an APNZ associated company, wherein Matthew Blomfield had treated the APNZ associated entity’s bank account to a little cash it should not have received. Of course at the time it is alleged that the APNZ associated entity should have ranked as an unsecured creditor and thus was arguably paid unlawfully.

It seems, prima facie, that exactly the same tactic has again been used by Blomfield, Johnson et al, although the question that the NBR failed to ask of the liquidator is very important; who exactly was it that benefitted from the disbursements that Bruce Johnson made from his trust account, following receipt of the $37’000.00 payment from Dan Blomfield’s company immediately before the appointment of the liquidator?

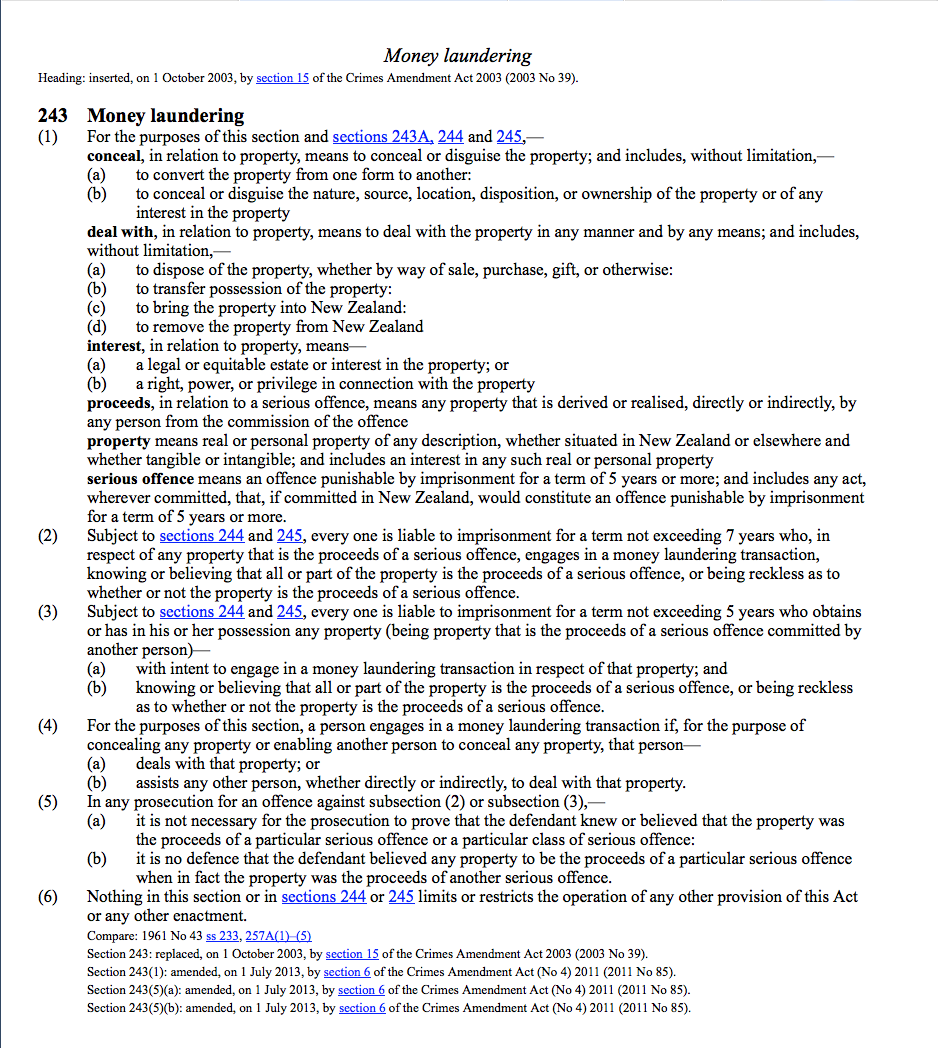

The next question the NBR journo should have asked is this; Why exactly is it that the liquidator, Grant Thorndon, in its wisdom has decided to wait until the liquidation might become insolvent before they intend investigating and chasing this highly suspicious, “it does stick out”, payment of $37’000.00? Another factor that should perhaps be looked at with respect to this questionable payment of $37’000.00 into Bruce Johnsons, aka Central Park Legals, trust account is the Crimes Act offence of money laundering. Depending on the particular circumstances, potentially, the law encompassing this offence may also have been flouted.

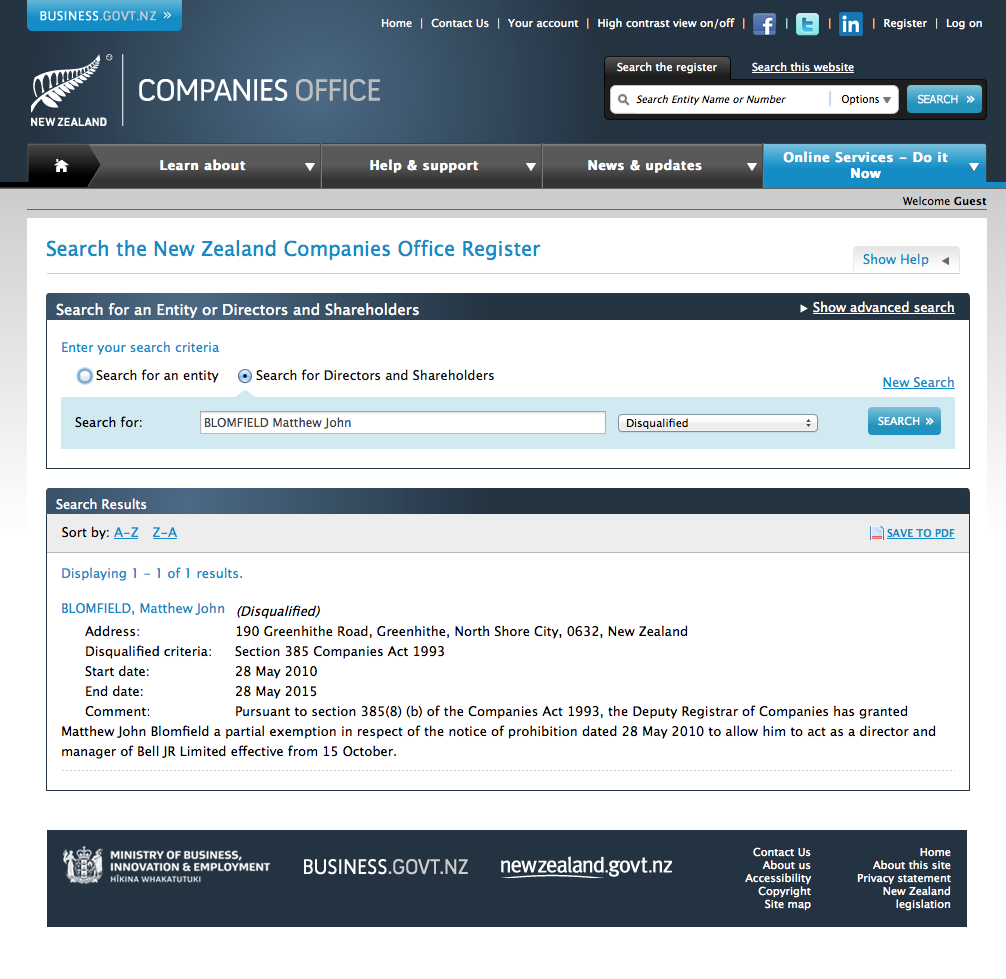

It seems to us that Grant Thorndon associate Greg Sherrif may just now be attempting to justify his appointment and that of Matthew Blomfield to assist in the liquidation (which of course required Thorndon to obtain a special dispensation for Blomfield, given that he was on the register of banned company directors).

It also seems to LF that Greg Sherrif has not run the liquidation by the book, and that in not investigating the highly questionable $37’000.00 payment, which he himself has admitted in the NBR article, looks shady, he has failed to secure the interests of the company’s creditors. With that in mind it also appears that he’s been willing to be yet another puppet, a “friendly liquidator”, doing little more than facilitating the scams, either by omission or commission, of Blomfield, Johnson and their cabal.

As aforesaid Greg Sherrif, in LF’s opinion, has and continues to act in a manner that is not strictly in accordance with a liquidators duty. That is perhaps only to be expected given that he is whats called often termed a “friendly liquidator”, we’ve seen them before.

The 50 Million Dollar Fraudster, Malcolm Duncan Mayer, employed this ruse by installing his friend and fellow fraudster, the far from qualified vexatious litigant Warren Arthur Wilson, appointing Wilson as liquidator just before the shit hit the fan, of course Mayer is now banged up in a prison cell, having been convicted recently, following a successful investigation and prosecution by the Serious Fraud Office (SFO).

LF suspects that the creditors of Dan Blomfield’s company should immediately apply to the courts to have Greg Sherrif removed as liquidator and replaced with a liquidator that will work in the interests of the creditors; not the Blomfield brothers, Johnson et al.

That further, they should seek court orders requiring the court appointed liquidator to investigate what appears, prima facie, to have been a preferential payment to unknown beneficiaries……..perhaps, arguably unwarranted payments to the Blomfield’s and or co-conspiritors.

As for the alleged Greenhithe assault and “firearm incident”, well given that the NBR is reporting that the, “NZ Police say they have no further comment on the matter”, such a serious matter too, one is given to wonder if it ever really even occurred; if the “armed and dangerous” Polynesian “Spiderman” was little more than another criminal machination, yet another lie, another colourful figment born of Matthew Blomfield’s seriously fucked up imagination.

LF suspects that there is a whole lot more yet to come in the “Epic Saga” of Matthew John Blomfield takes on the world. We also suspect that another front may eventually open up….. Yelcich v NZ Herald and Ors

No Comments

Says it all really !!!!!!!

From: “Matthew Blomfield”

Date: 27 April 2010 10:59:49 PM PDT

Perfect……Bio as follows:

Mr. Blomfield is a talented individual who has a set of skills that have enabled him to create a debt empire of unimaginable personal liability. Capitalising on the recent failures in the economic and credit systems Matthew managed to acquire unsecured personal debt in excess of five million dollars. During his short and infamous career Matthew has been the proud recipient of 43 separate court proceedings (in ratland these are almost Oscars). This has given Matthew a unique skill set with companies such as the ANZ referring to him as impossible to Bankrupt (they attempted with three separate lawyers). In the last two years Matthew has had a total of 5 private investigators follow him and has been referred to as a rat who will soon be remembered as a cockroach.

Matthew is now working hard on a formal compromise with all of the 18 creditors that he has, of which he owes an estimated 3.5 million dollars. If successful this will cement his place in history as one of New Zealand truly hard to kill cockroaches.

Favourite Line: In business I would like nothing more than to be New Zealand greatest business enigma.

Hey Redacted,

Thanks for that information.

Would you have a Bio on Matt Blomfield that you could send through to me?

Also would Stu (Hell Pizza Director) a work colleague be available/ interested in this?

Thanks Redacted

Kind Regards

Melanie McLeod

Sales Coordinator

T:+64 9 308 3608 | F:+64 9 303 4422

Level 4, 149 Parnell Road, Parnell, Auckland

melm@csnz.co.nz

| website | news | our team | events |

Email Disclaimer:

This email and any files transmitted with it are confidential and are intended solely for the use of the individual or entity to whom they are addressed.

Copying or use by anybody else is not authorised. If you have received this email in error, we apologise. Of course though if anyone needs to they can.

Please advise the sender by return email and delete immediately.

Browse profiles for Free! Singles online now!

So now the NBR have taken down version 2 of the article ! How does Matt do it???

Actually thinking about it nothing new on how Matthew will view and deal with this, Matthew will see himself as the Victim in a wicked plot to hurt him and his family.

The excuse I have heard often from Mr Blomfield is “I was only acting as a Employee under instruction”. Clearly untrue but it has allowed Matthew to murk things up and got him off the hook on a few occasions. In this case Matt will be acting as a agent for the Company or Thorton and taking instructions on Debtors and Creditors from his brother so his brother will be the scape goat with Thorton close behind. Matt will be the poor guy caught up in it, the innocent buy stander just trying to help.

In this case Matthew will say he was asked to assist collect monies and was acting under instruction from Grant Thornton. Grant Thornton will now know what it is like to deal with Matthew and they will pay the cost, not Matthew or Dan.

Well I should explain, the Creditors and Greg Sherriff will pay the ultimate price. Grant Thorton will will no doubt be charging even the reporters calls to billable time.

Who approached Grant Thorton to Liquidate the Company, Matthew Blomfield is a likely front. It may have gone like this, “my brother is in or going to prison, he has a big debtors list and small creditors list, will you liquidate the company for him, it is a easy liquidation, simple in fact, I can even help collect the money if you like as I know the debtors”. Maybe Grant Thornton simply let their guard down to the bearded Santa.

It is really sad but I see Matthew hiding behind Sheriff, Sheriff and the Creditors paying the price and Matthews Stories of hardship and plots against him continuing.

The Debtors and Creditors list look like suspect as heck but who knows, is BJ Cool a real Company / person?

Marc’s comments of course give weight to Matthews story of plots and sub plots, relax Marc, relax.

So who took the Liquidation to Grant Thorndon? 10 bucks says it was one MATTHEW JOHN BLOMFILED which raises issues everywhere,

The Liquidator is just getting played like John Price and Gary Whimp who liquidated many of Matthews Companies before Matthew went Bankrupt. In fact in a scary flash back, Matthew was involved in collecting money for John Price, maybe that was part of the sales pitch.

I agree with the Monkey, doesn’t a Creditors list need to be supported by Invoices and Accounts? What sort of liquidator allows a Solvent Liquidation on claims of money owing but no supporting documents?

Wouldn’t that raise tax issues within the company being liquidated and raise a few red flags? Doesn’t a liquidator have to report such issues? Would such issues immediately see the replacing of the very CONFLICTED person collecting the money, especially as that person is a recently discharged BANKRUPT and BANNED DIRECTOR.

Matthew and Dan are burning through the Liquidators these days, who will touch them on the next adventure?

Mike Alexanders time is nearly up – he knows he paid money from Hoyts that went to Vengeance to APN via his Trust Account – duping creditors all over the show. And whats worse is Blomfield cost a couple of girls their jobs on this little gem. Garry “I am having anal with Matt” Whimp knows he has fucked up right royally here and he’s just a small handed wank away from getting jizz on his back on this one – hide behind Martelli McKegg Garry – you little jizz drinker.

Marc relax, they will all get away with it, they always do. But it may slow them all down and and slow others down before dealing wit any of them.

Boris and the likes in my opinion can only hope bring these things to peoples attention will help other not get the same results form their dealings with Matt, Dan, Bruce Johnson and Mike Alexander.

I love the way “if it becomes a insolvent” liquidation matters, Matt and Bruce will have a invoice ready to cover that one. The question is have they sorted the tax issue around it all.

The top of the article is very accurate, Mr Slater and Mr Blomfield are brother in many ways, I would think they will end up doing a silly deal, coming to a arrangement to shake hands and move on and in Matt Blomfield fashion Mr Slater will even start to put articles feed to him by Matt up. After all that is what Matt does, gets something on someone, leaks things to the papers.

I am guessing Matthew still has the guy at the Standard to push his hate and of course Bevan Hurley from the Hearld on Sunday although I think Weekes is starting to take over that role.

It is a comedy that Slater is at war with Matt, two jokes of men, no winner if either wins but again, to make it like ground hog day Slater and Blomfield will shake hands and make up, Slater too LAZY to follow through, Blomfield simply can not win if Slater gets into gear.

This is just criminal – these cunts owe me money as well. I hope the bash in the face in front of the kids hurt Matt – still i guess the visit they got is a normal Saturday night for a cunt like Blomfield. Clearly Grant Thornton is on a take on this one, or at a minimum covering ass. I mean really – $37K might be looked at of it becomes Insolvent – it was never solvent to start with………. unless of course if you believe Jackie Chan and BJ McCool – FFS when will people see what they are dealing with !!!!!!!!!!!!

Amazes me that the Liquidator could not have very quickly asked Bruce Johnson to repay the funds from his firms Trust A/C – as after all NO lawyer would ever pay out any funds without the proper paper work – oh wait its a Blomfield transaction. I bet Grant Thronton wished they had listened to the tipster who said dont do this one. But then to top it off the NBR have revised the bloody story to be nice to Blomfield ! WTF!!!!!!!!!! How can a liquidator claim that jail bait Dan Blomfield will leave prison within 3 months? is this fool now a Judge? Dan Blomfield is a wife and child basher who got another 22 months – easy abacus maths says he has ages to go and that will include trying for parole…. good luck with that Dan!

The facts presented by the NBR do raise a number of questions which I am sure the NZICA, Official Assignee, MBIE and perhaps some other agencies should be asking of the liquidator and Matthew Blomfield:

1. Why would a reputable insolvency practitioner such as Grant Thornton seek the out the assistance of an incarcerated company directors sibling, to recover any monies outstanding by creditors? And is it standard practise of Grant Thornton to seek the services of a directors sibling to recover monies in a liquidation? (which does seem like unorthodox practise)

2. Matthew Blomfield (whilst not presently bankrupt) is still banned from being the director of any company until after 28 May 2015. So under what guise has Grant Thornton engaged the services of Matthew Blomfield?

3. Surely Grant Thornton have an obligation, by law, to refer the the withdrawal of the funds on the 28 October 2013 ($37,000 that is known of) 11 days prior to their appointment to the Police as potentially matter of theft by person in special relationship? Has Grant Thornton done so? And acted in the manner set out and required of them in the Insolvency Practitioners standards set out by the NZICA?

4. Is it coincidence that the $37,000 was transferred to Bruce Johnson of Central Park Legal? Matthew Blomfield’s long-time friend and legal advisor?

5. Being that Dan Blomfield was (and still is) incarcerated on the 28th of October 2013 and subsequently the 9th of November (when GT were appointed), who has been acting in the capacity of director? And furnishing them with the information relied on in their first liquidators report?

6. Should some accountability to creditors lie with Grant Thornton? After all in their first report they stated that the liquidation, “on the face of it, to be solvent which will mean that creditors stand to be paid in full.” Given Greg Sherriff of Grant Thornton now claims “the likelihood of a solvent liquidation” is the case, surely one would think so?

7. Just how many irregular liquidations has Matthew Blomfield been involved with? These need to be examined thoroughly, as a consistent MO is likely to appear. Whats more is the IRD is probably the biggest creditor/victim of Blomfield related liquidations.

8. Did Grant Thornton verify the authenticity of the creditors? As per their first report? Who is BJMcool?

So many questions that need to be answered.

I’d suggest that any wise creditor to this liquidation file a complaint with the NZICA to ensure that the conduct is at a minimum meeting the required standards.

Lastly, Greg Sherriff seems to be confused as to whether the liquidation is solvent or insolvent.

He describes above the likelihood of a solvent liquidation as ‘doubtful’. Then when the matter of the $37,000 withdrawal of funds is raised his comment is that it ‘will be looked at if the liquidation becomes insolvent’. So which is it Greg? Solvent or insolvent?

Perhaps the best thing Greg Sherriff and Grant Thornton could do is resign the liquidation to a practitioner more conversant with the hallmarks of a Blomfield liquidation?