In Auckland the price of residential housing has reached a critical point. Interest rates are at record low levels never seen before in the lives of most first home buyers. The government moved to try and ease pressure on the market by making the minimum deposit 20% which effectively meant that the only buyers hurt were first home buyers. But that’s John Key for you.

Investors can use cash and equity in their current portfolio meaning that the rich get richer. Australians have always been big investors for a number of reasons. One of the biggest reasons why Aussies buy in New Zealand is that they avoid property tax, which in Australia is about 30% on any profits made on properties other than your own residential dwelling. In Australia there is also massive stamp duties that often amount to as much as the real estate agents fees.

Then there are the other immigrants that come into the country that have a lot of money. These people are mainly Asians, and of this segment, the wealthiest are mainly Chinese.

The buck starts in China and stops in Auckland property making it impossible

For Kiwis to buy their own homes – and John Key moved to make it even harder for first home buyers

At auctions, prices have been going through the roof as the lack of stock hits record lows, and immigration flow accelerates to form a value vacuum upward to celestial levels, which is, to an extent, saving the bacon of those previously hit by the global property collapse of 2007 – 2009, but what cost is it for those trying to buy for the first time. In New Zealand property prices have doubled each 7 to 10 years, and if the numbers were done these recent increases are probably just an adjustment back to doubling 2007 values by 2015-2016. But what happens in the next 12 months will prove crucial to whether a generation of kiwis will be renters all of their life.

LF wonders if Auckland’s future for housing New Zealanders will be the solution of their most recent immigrants – thanks to John Key

But no one can argue that Auckland, the countries real capital city, is the only place cash rich immigrants want to live. It is the only true international class city in New Zealand, has a wonderful harbor, is cosmopolitan, and a larger percentile of inhabitants have not been hit with the ugly stick, and of course house prices always go up, unlike the other cities who have not had the recovery in value because the inhabitants are poor, dumb and ugly.

LF research on the poor, dumb, and ugly aspect of this article is based on information relating to our researchers incredible prejudice and dislike for people who come from anywhere but Auckland, so its pretty reliable.

But what’s the answer to removing the “pressure cooker” environment to the current Auckland price hike, which may be about to take off again once the banks are back in the market come February 2014.

Well we recently read a tweet by Dermot Nottingham that suggested that the answer lay in only allowing immigrants that have come from countries that allow reciprocal property ownership to New Zealand citizens. Nottingham tweeted that this would cut out the Chinese, and most of Asian.

One of the reasons for attracting wealthy Chinese immigrants is because they bring money, and allegedly lots of it. Automatic citizenship comes with $10m NZD being deposited in a New Zealand based bank account, or the purchase of property or business interests to the same value. At this level an immigrant does not even have to speak “engwiish”.

Following the global financial collapse on 2007 New Zealand was not alone in trying to increase immigration of wealthy Chinese who cannot actually own a single square millimetre of their home turf, and therefore love the idea of buying others mud in large amounts.

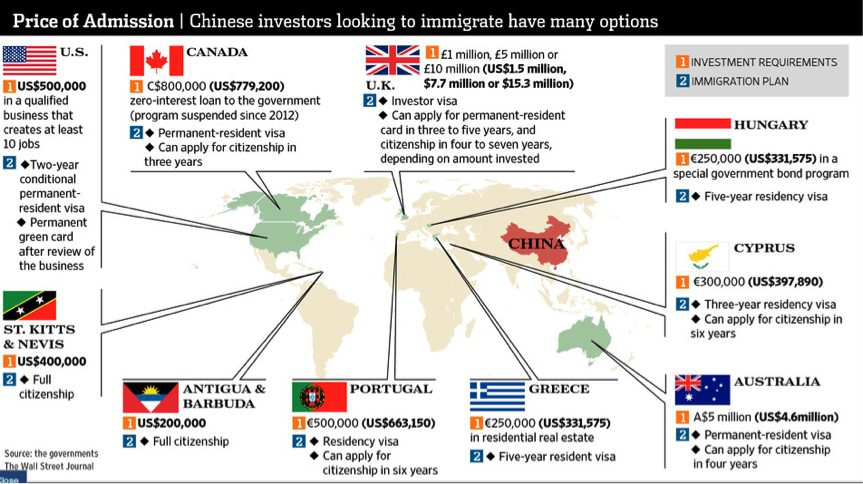

Since 2007 cash-strapped governments slashed requirements for visas and citizenship to attract particularly wealthy Chinese immigrants in the hope of drawing capital to their shores.

While investor immigration programs are technically open to all, immigration lawyers say that governments are targeting anxious Chinese who are looking for potential escape plans for their families and protection for their assets in case of turmoil at home, which turmoil is not if, but when.

Jean-Francois Harvey, an immigration lawyer at Harvey Law Group in Hong Kong stated of the competition to attract chinese immigrants;

“There is an all-out immigration war emerging for the Chinese,”

The best deals of the moment come from countries in the Caribbean and Southern Europe suffering from weak economies and heavy public debt loads. The attractions are visas or citizenship that allow for relatively unfettered travel and cheap real estate, either for investment purposes or for homes.

In the eastern Caribbean, the island nations of St. Kitts & Nevis and Antigua & Barbuda are battling it out to attract immigrants. Both nations are struggling in a region wrecked by hefty public debt loads and anemic growth; the International Monetary Fund forecasts the Caribbean region’s 2013 growth at just 1.25%

St. Kitts, a tiny island nation with a population of about 53,000 that lies 1,200 miles southeast of Miami, has led the charge in easing citizenship requirements in the region. Citizenship is granted to those who spend $400,000 on real-estate investment or donate $250,000 to the country’s Sugar Industry Diversification Fund. A St. Kitts passport offers visa-free travel to most Western countries.

Not to be outdone, Antigua & Barbuda, St. Kitts’s neighbor 70 miles to the west with a population of about 90,000, is set to launch its own program. Modeled on the St. Kitts program, an Antigua citizenship can be acquired for a limited time for a donation of $200,000 to the country’s national development fund.

Hong Kong-based immigration lawyer Denny Ko, whose firm, Henley & Partners, was hired by Antigua to help set up the investor immigration program said of the program;

“It’s a niche product, but a niche product for China is still big numbers,”

Although Antigua’s program hasn’t started yet—politicians are debating whether the country should require participants to live in the country for a number of days each year—but the marketing for it has already begun.

Government officials in both Antigua and St. Kitts won’t reply to requests to comment.

Another battle over residency visas is playing out in Southern Europe. Greece’s government is promising renewable five-year resident visas to foreigners who spend at least €250,000 ($328,000) on residential property—undercutting its neighbors’ visa offers by at least €50,000.

The program, which is about to be launched, offers visas that allow free travel in most of Europe for 90 days every six months. Portugal last year began offering a “golden visa” to foreigners who purchased a house valued at least €500,000, while Cyprus also launched a program for those who spent at least €300,000 on a property.

Hong Kong-based immigration lawyer Wendy Wong at S.W. Wong & Associates who serves mainland Chinese clients commented about the European drive to reduce debt and build internal cash surpluses;

“Everybody in Europe is coming to us to sell their houses to the Chinese,”

A spokesman at the government agency Invest in Greece said that the lower price was intended to attract more residents to the country.

A spokesman for government-run Cyprus Investment Promotion Agency said 1,000 properties have already been sold to Chinese investors, mostly in the coastal town of Paphos. The spokesman reported;

“We can’t comment on whether Chinese investors would be interested in Greece,……We’re focused on ensuring that the Chinese people who invest in and move to Cyprus are warmly welcomed,”

Spain is planning a similar residency option but it hasn’t released details.

But for some Chinese investors, the visa isn’t everything. Hungary last year began offering five-year residency visas to those who invest €250,000 in a special government bond program, but programs like these are less interesting to Chinese, who typically want to buy real estate for use as rental properties, vacation homes, or simply leave them empty in hopes of a rise in housing prices. Denny Ko of Henley & Partners opined;

“The mentality among most Chinese is they look at the real estate first, and the visa second,……Some just view the visa as a bonus.”

Wealthier countries are also eager to attract Chinese but the price is steeper. In the U.S., the cost is US$500,000 and the creation of a certain number of jobs.

According to data from the U.S. State Department, [in the fiscal year ending September 2012,] 80% of the 7,641 applicants to the US program came from mainland China.

In November 2012 Australia launched a “significant investor” visa that allows foreigners to settle for up to four years in exchange for a 5 million Australian dollar (US$4.6 million) investment into bonds, managed funds or equity investments. As of May, the country attracted 170 applicants, most of which are believed to be Chinese, representing a total investment of $850 million AUD.

So New Zealand is not alone, excepting in the number of immigrants it attracts for its size, punching far above its weight to the detriment of New Zealand born citizens.

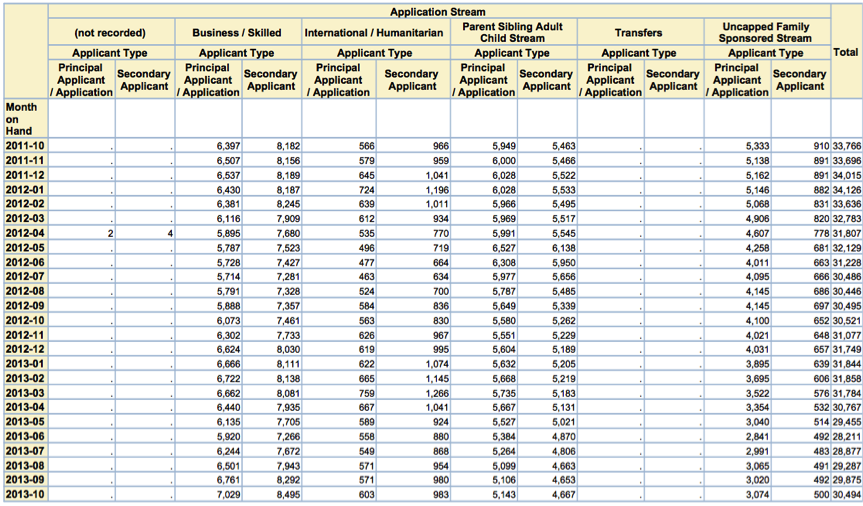

The numbers speak well of how the Asians are targeting New Zealand property to an extent that Auckland property will be unaffordable to those not on the ladder. New Zealanders will be a generation of renters.

80% or more of those under business/skilled are Asians who are getting accepted because they are by New Zealand standards, rich – only because they are not on the poverty line – which a lot of New Zealanders are. Oh and they can buy houses – lots of houses cash – to rent to Kiwis.

No Comments

LF and Elton – thank you for your contributions and the evidence. I should have been more careful in my comment and said ”the article appears to me to be a xenophobic rant” and qualified it by acknowledging my ignorance of the underlying facts and the caveat that appearances are often wrong. I gladly retract the comment and apologise to LF. It was not the identification of the Chinese as the driving force behind the problem that I objected to. Had that been so I would have said ”racist rant”. It was the assertion that ALL immigrants are detrimental to the ability of prospective first-time New Zealand house buyers to get a foothold in the market. That is why I quoted the words ”the number of immigrants New Zealand attracts” Yes, LF, my wife is of Chinese ethnicity but, like me, is seriously not wealthy and not a cause for my being overly sensitive about comments concerning others of her ethnic group. Contrarliy, I am not enamoured by many of their cultural mores. And yes,LF, we now reside in the UK after living in New Zealand as Permanent Residents with the intention of applying for New Zealand citizenship until my wife, the major source of our income, was well and truly fucked over by her corrupt and conspiratorial and racist employer. Our return to the UK was not a matter of choice but necessity. Attending Auckland house auctions is impracticable. If Chinese buyers are the problem then legislate to keep them out of the market. Malaysia, for example, does not permit foreigners to buy properties below a certain value neither does it grant residence or citizenship. Politically Correct? Nice one LF.

Harry

Your comment about a xenophobic rant devoid of any analysis is in itself unsubstantiated for the following reasons. The article is full of references to data about the cash for immigration issue “globally” and that the Chinese make up most of that equation. I have been at least 150 auctions where Chinese immigrants have left Kiwi bidders behind at reasonable levels for a property to pay up to 30% over the top. Now the New Zealand market is an interesting market, unlike any other that I have come across and I have owned property all over the world. The advent of the population growth through very wealthy Chinese in such vast numbers means that the supply and demand issues, and the low Kiwi incomes, make competition against the Chinese impossible. Most properties are purchased to rent, and hold and the Chinese owners expect large profits when they sell. Now the more wealthy Chinese that come in and buy large holdings expecting large profits means that the net effect is that those [Kiwis] that cannot afford the property the first time around are far worse off the second time around. Don’t get me wrong the Chinese make mistakes as well. I was at an auction for a property and I was third highest bidder at $675k. My next door neighbour thought the property was worth $650k with a bullet up its arse. The other two Chinese bidders took the property through to $955k. Afterwards the agents were laughing their tits off at the level, as was the family trust that has sold the property. At the auction were about 20 kiwi couples of all mixed nationality who came along because they thought the property was in their range. The winning bidder painted the house and then put it back on the market and sold it by negotiation for a loss of around $50k. But I have seen the 20 to 30% divergence in affordability literally hundreds of times. In my opinion the problem is far worse than painted in the article, and I know what I am talking about. Just because the Chinese are the cause of the massive price increase in housing does not make an article xenophobic.

Do your research before throwing stones Harry. A bit of “on the ground time” in the auction rooms might be a good start. If the Chinese were stopped from buying property the market would substantially retract. Immigrants cannot buy freehold land in Thailand for this very reason. It allows the low income Thai’s to still be able to buy property.

So, where is your evidence that the number of immigrants New Zealand attracts is to the detriment of New Zealand born citizens, presumably with reference to the first-time buyers market for real estate in Auckland? This article is a xenophobic rant devoid of any analysis and I am surprised to see it on LF. Have you considered that the housing situation in Auckland might be the result of supply side factors?

G’day Harry,

Team LF are certainly not “xenophobic”, as regular readers will undoubtedly know. This particular story is based on sound research.

Whilst you might want everyone to believe that by LF identifying the “ethnic group” responsible for the growth of the problem LF should then, by default, be labelled Xenophobic, well frankly it’s an over the top “Politically Correct” argument that simply won’t fly, at best it can only be seen for what it is, pure PC CRAP; which we might add, coming from you Harry Stottle, has certainly surprised team LF.

Lets first look at various “facts”, as also reported by other media, albeit MSM. Both Australia and New Zealand are in the grips of an Asian foreign investment boom, being driven by their own “Chinese” Governments legislative crackdowns, in particular Chinese domestic property investment crackdowns that have led to a foreign investment boom being driven by cashed up and hungry Chinese investors.

http://www.smh.com.au/comment/investors-become-like-bulls-in-a-china-shop-20131027-2w9ki.html

That fact has caused serious concern on both sides of the Tasman as it is impacting on first home buyers ability to get into the market. Interestingly the New Zealand Herald ran a similar story on the back of ours:

http://www.nzherald.co.nz/nz/news/article.cfm?c_id=1&objectid=11181102

Although the NZH story was “politically correct”, starting with the Hollywood moguls buying up New Zealand rural land and only briefly touching on the Chinese component, which in reality is the driving force behind this worrying trend.

The Australian SMH story by Paul Sheehan is however much more accurate, as Sheehan calls it as it is, along with a narrative by a friend who had attended auctions. Perhaps if you yourself started attending a few auctions Harry you might just have a change of heart; its a hard ask Harry, after-all you’re residing in the United Kingdom.

Sorry if we have offended your PC sensibilities Harry but the problem exists, it is impacting on young Australasians and their ability to source affordable housing, heads stuck in the sand and the unwarranted use of PC rhetoric will not change that reality, only an open, frank and honest public debate will.

http://www.theaustralian.com.au/business/property/chinese-new-wave-rocks-property-market/story-fn9656lz-1226747147870

Hi Harry,

Having said the above LF always welcomes evidence contrary to our arguments, so if you are ever able to provide evidence that contradicts our argument please feel free to provide it; laudafinem@bigpond.com

As always, if genuine, details will be treated with respect and your name and any identifier will be kept as an anonymous source.

badabing badaboom lets get Key

Excellent article. Thankyou